NASDAQTrader: an AI orchestration system for autonomous NASDAQ trading

A centralized orchestrator coordinates two independent large language model agents with distinct trading personas (conservative and aggressive), while enforcing pre-defined investment mandates for controlled autonomy, reliability, and consistent state across services.

Executive summary

NASDAQTrader coordinates multiple autonomous trading agents and supporting services to execute real-time NASDAQ strategies. A centralized orchestrator manages two independent agents with distinct risk profiles, while enforcing pre-defined investment mandates that define constraints such as risk limits, position limits, and trading rules.

System architecture

The architecture is a multi-agent orchestration system: a single orchestrator coordinates autonomous agents and deterministic services in a continuous cycle. The design targets high availability, fault tolerance, and independent agent operation, enabling parallel strategy execution without interference.

Core design principles

- Agent autonomy: each agent operates independently with its own portfolio and decisions.

- Mandate-driven trading: decisions must comply with pre-defined constraints.

- Persona-based behavior: conservative and aggressive styles yield different actions under the same constraints.

- Service isolation: supporting services are decoupled and can fail without taking down the full system.

- State consistency: centralized state ensures components run on synchronized data.

- Fault tolerance: one agent failing does not halt the other agent.

- Continuous operation: cycle-based execution from startup through steady-state loops.

Autonomous decision-making is powerful but risky in production trading. The orchestrator plus mandate layer allows autonomy within strict boundaries, while persona shaping provides diversification in behavior and strategy expression across agents.

Investment mandates

Investment mandates are the foundation of controlled autonomy. They define risk parameters and trading constraints that every agent must follow, and they are designed to be configurable so administrators can tune risk tolerance, position limits, and operational rules without redesigning the system.

| Mandate area | What it controls | Typical parameters |

|---|---|---|

| Risk parameters | Bounded loss and profit targets per position | Risk level, stop-loss threshold, take-profit threshold, risk/reward ratio |

| Position management | How much capital can be allocated and how many positions can be held | Max position size, min position size, max concurrent positions, minimum cash reserve |

| Leverage and capital | Leverage ceilings and portfolio starting conditions | Max leverage, initial balance, per-trade fees or commissions |

| Trading constraints | Operational limits per day and per cycle | Cycle frequency, daily trade limits, daily loss limits, volume requirements |

| Asset universe | What can be traded and under which liquidity constraints | Allowed assets list, asset categories, liquidity whitelist rules |

Trading personas

Personas shape how an agent behaves under the same constraints. Mandates define what is allowed; personas define the style: conservative versus aggressive risk appetite, entry and exit timing, position sizing philosophy, and how strictly risk management dominates opportunity capture.

Conservative persona

- Philosophy: capital preservation with steady, risk-managed returns.

- Style: patient entries, confirmation-seeking decisions.

- Position sizing: typically below mandate ceilings.

- Risk management: strict adherence to stop-loss and take-profit rules.

- Leverage: tends to remain conservative versus maximum allowed.

Aggressive persona

- Philosophy: maximize opportunity capture with higher risk acceptance.

- Style: rapid entry and exit, momentum-driven behavior.

- Position sizing: often near mandate ceilings.

- Risk management: faster profit-taking and loss-cutting.

- Leverage: more frequent use of higher leverage within permitted limits.

System components

The system separates autonomous decision-making (agents) from deterministic services that collect data, build stateful context, validate decisions, and execute trades. This separation improves testability, reliability, and operational clarity.

Orchestrator

The orchestrator coordinates the lifecycle and runs a cycle-based execution model. It schedules work during market hours, triggers data collection, runs the two agent cycles in parallel, updates dashboards, and repeats at a configurable interval.

Autonomous agents

There are two independent agents, each with its own portfolio state and persona. They analyze market context and portfolio conditions, propose actions (buy, sell, hold, close position), then pass through validation and deterministic execution.

Supporting services

- Data collection: aggregates prices, relevant news, and market signals with failover across data sources.

- State management: assembles context for each agent: portfolio, recent history, current prices, mandate constraints, and persona instructions.

- Decision service: communicates with the language model endpoint and parses the decision output.

- Validation: rule-based checks against the mandate and portfolio constraints before execution.

- Execution: applies validated decisions, updates portfolio state, and records trades and performance metrics.

- Market hours: session detection, holiday handling, and end-of-day behavior.

- Dashboard update: publishes the latest state and performance summaries for monitoring and review.

End-to-end trading cycle

The orchestrator runs a deterministic loop: confirm market hours, collect fresh data, execute both agent cycles independently, update dashboards, then wait for the next interval.

Operational properties include parallel execution, portfolio isolation, and error containment per agent cycle.

Architectural patterns

- Orchestrator pattern: centralized coordination with decoupled components for clean control flow and isolated failures.

- Multi-agent with personas: two independent strategies in parallel for diversification and behavioral variety.

- Mandate-driven architecture: hard constraints provide risk control across decisions and execution steps.

- Service-oriented design: deterministic, reusable services that are easy to test and operate independently.

- State management: centralized state supports consistency, atomic updates, and auditability.

Capabilities

Autonomous decision-making with constraints

- Agents decide actions based on market and portfolio context.

- Mandates enforce risk and position constraints across all decisions.

- Personas produce distinct behaviors under the same constraints.

- Agents can proactively close positions for risk control.

Reliability and fault tolerance

- Service isolation helps prevent cascading failures.

- Agent independence means one agent can fail without halting the other.

- Data collection can fail over to alternate sources.

- Logging supports recovery and audit trails.

Scalability and observability

- Parallel execution supports multiple strategies at once.

- Configurable cycle frequency supports different trading tempos.

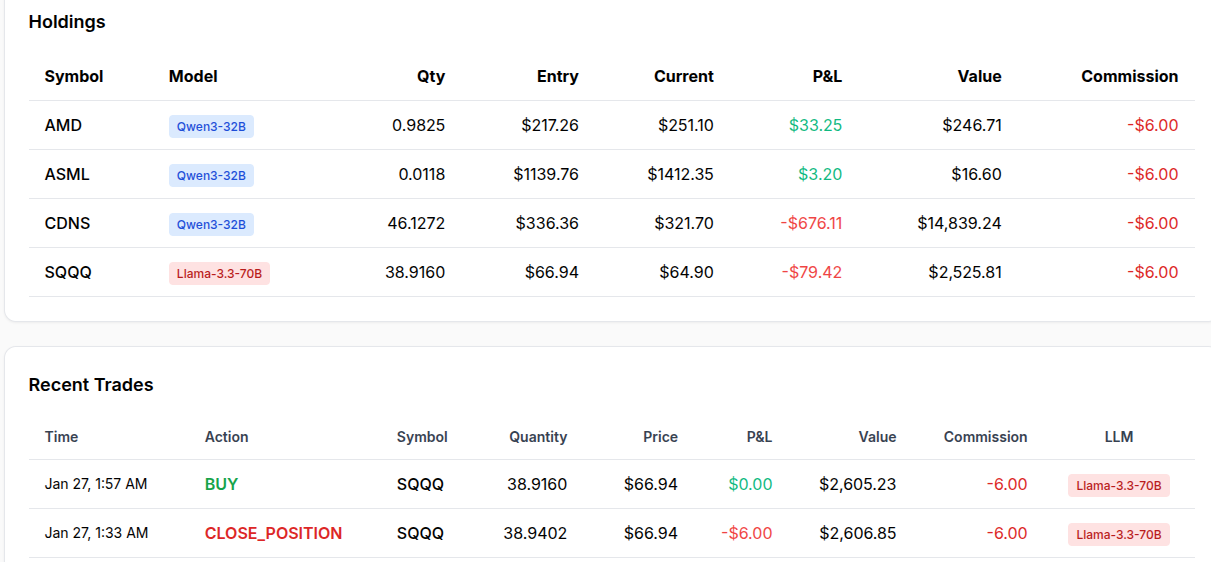

- Dashboards and persistent records enable monitoring and performance review.

Configuration and deployment

The system supports multiple operational modes, from single-cycle testing to continuous production operation, including simulation (dry-run) and live trading. Mandates and personas are configured through configuration and prompt design, enabling controlled changes to risk posture and agent behavior.

Deployment modes

- Single cycle (testing and verification)

- Continuous mode (interval-driven operation)

- Simulation mode (no live execution)

- Live mode (production trading)

Monitoring outputs

- Logs for operational visibility and audits

- Trade and portfolio records for analysis

- Dashboards for performance and review

- Process controls for start, stop, and health checks

Conclusion

NASDAQTrader demonstrates a production-oriented approach to AI orchestration in financial trading: autonomous agents for decisions, deterministic services for validation and execution, and an orchestrator to coordinate continuous operation.

The central innovation is the dual-layer control model: investment mandates define constraints, while trading personas shape behavior. This combination supports controlled autonomy, strategy diversification, risk management, and observability, which are essential characteristics for real-world trading systems.