CryptoTrader: an AI orchestration system for autonomous crypto trading

A centralized orchestrator coordinates autonomous trading agents with mandate-driven risk controls and persona-based behavior, operating across market regimes including high-volatility bull runs and deep bear markets. CryptoTrader also models bear-market exposure using inverse instruments such as ETHDOWN and BTCDOWN, alongside spot and derivatives workflows.

Executive summary

CryptoTrader is a multi-agent orchestration architecture for autonomous crypto trading. It coordinates independent agents and deterministic services in a loop: collect market data, build context, generate decisions, validate against mandates, execute trades, and publish monitoring outputs. This mirrors the core flow described in the attached architecture, including data collection, context building, decision generation, validation, execution, and continuous risk monitoring.

System architecture

The system follows an orchestrator pattern that coordinates all components while keeping services decoupled and failures isolated. The design supports parallel agents with independent portfolios, enabling side-by-side strategy comparison and reducing correlated risk.

Core design principles

- Agent autonomy: each agent makes decisions independently with its own portfolio state.

- Mandate-driven constraints: every decision is bounded by explicit risk and trading constraints.

- Persona-based behavior: two or more agents express different styles under the same hard limits.

- Service isolation: data, validation, and execution are decoupled and can fail without collapsing the system.

- State consistency: portfolio snapshots and market context remain synchronized across components.

- Continuous operation: cycle-based orchestration with deterministic sequencing and error containment.

Crypto trading universe

CryptoTrader targets crypto-native market structure: 24/7 trading, fragmented liquidity across venues, and rapid regime shifts driven by macro news, exchange flows, on-chain activity, and derivatives positioning. The system is designed to plug into multiple execution venues, including centralized exchanges and decentralized exchanges, while treating venue-specific mechanics as execution-layer concerns.

Signals and data sources

- Price and microstructure: OHLCV, order book depth, spread, volume, volatility, slippage.

- Derivatives: funding rate, open interest, basis, liquidations, perpetuals, futures curves.

- On-chain: whale flows, exchange inflows and outflows, stablecoin supply, gas and congestion, bridge activity.

- News and sentiment: headline risk, narrative shifts, social sentiment, risk-on versus risk-off signals.

Bear market trading with ETHDOWN and BTCDOWN

Crypto bear markets demand a different toolkit: drawdowns can be sharp, volatility clusters, liquidity can thin out, and forced selling can cascade through liquidations. CryptoTrader explicitly supports bear-market decision pathways where agents can seek inverse exposure and hedges.

This write-up includes bear-market instruments such as ETHDOWN and BTCDOWN, modeled as inverse exposure products that aim to gain when ETH or BTC falls. Availability and exact mechanics vary by venue, and listings can change, so treat these as configurable instruments and verify the current listing status with your exchange.

Bear market playbook inside the mandate

- Regime detection: classify market regime using volatility, trend strength, and derivatives stress.

- Inverse exposure routing: select inverse instruments when mandate allows short exposure or hedging.

- De-risking: reduce beta, increase stablecoin allocation, tighten stop-loss, and shrink position sizing under elevated volatility.

- Slippage-aware execution: use liquidity checks and price impact estimates to avoid chasing illiquid candles.

- Event risk gates: reduce sizing around macro events, exchange incidents, or major protocol events.

Investment mandates

Mandates are the foundation of controlled autonomy. They define bounded risk, position limits, leverage ceilings, trading frequency, and loss limits, and validation enforces compliance before execution.

| Mandate area | Crypto interpretation | Example parameters |

|---|---|---|

| Risk parameters | Stop-loss, take-profit, volatility-aware sizing, drawdown control | Stop-loss %, take-profit %, max daily loss, max drawdown |

| Position management | Capital allocation per position and diversification constraints | Max position %, max concurrent positions, stablecoin reserve |

| Leverage and liquidation | Limits for margin, futures, perpetuals, and liquidation buffers | Max leverage, maintenance margin buffer, max notional exposure |

| Trading constraints | Cadence, throttles, and circuit breakers for stressed regimes | Cycle interval, trade rate limits, cooldown after losses |

| Asset universe | Allowed symbols, chains, venues, and liquidity constraints | Allowed list, minimum volume, venue whitelist, instrument types |

Trading personas

Personas define how an agent expresses its strategy. Mandates define what is allowed; personas define how aggressively an agent uses the available risk budget.

Risk-aware conservative persona

- Focus: capital preservation, stablecoin bias in bear markets, confirmation-driven entries.

- Execution style: avoids thin liquidity, reduces size under volatility spikes, prefers tighter slippage budgets.

- Derivatives: limited use, strong liquidation buffer, avoids funding-rate traps.

Opportunity-seeking aggressive persona

- Focus: momentum and volatility harvesting within mandate limits.

- Execution style: faster entries and exits, uses tighter time horizons.

- Bear market behavior: more likely to route to inverse exposure (ETHDOWN, BTCDOWN) if permitted.

System components

CryptoTrader separates autonomous decision-making from deterministic services that collect data, build context, validate decisions, and execute trades.

Core orchestration services

- Data collection: aggregates prices, news, and sentiment signals from external sources.

- Context builder: transforms raw data into agent-specific context including portfolio state and mandate constraints.

- Decision engine: obtains decisions from each agent's language model endpoint and extracts actionable instructions.

- Validation layer: checks mandate compliance, risk limits, and portfolio availability prior to execution.

- Execution engine: executes validated trades and updates agent-specific portfolios with accurate accounting.

- Risk monitor: monitors open positions for stop-loss and take-profit triggers and performs auto-closures.

End-to-end trading cycle

The orchestrator runs a deterministic loop: collect fresh crypto data, build per-agent context, execute multiple agent cycles independently, validate and execute trades, update monitoring views, then wait for the next interval.

Crypto-native risk management

Crypto risk includes liquidity gaps, slippage, liquidation cascades, venue risk, and operational failure modes. CryptoTrader extends the standard validation and monitoring pattern with crypto-specific controls.

Pre-execution validation

- Liquidity checks: minimum volume and depth gates to reduce price impact.

- Slippage budgets: reject trades that exceed a configured price impact estimate.

- Leverage and liquidation buffers: ensure maintenance margin buffers remain above thresholds.

- Venue constraints: enforce instrument availability per venue and per account.

Automated position management

- Stop-loss and take-profit: automatic closures triggered by thresholds.

- Cooldowns: throttle after consecutive losses or extreme volatility.

- Circuit breakers: halt trading on daily loss limits or degraded decision quality signals.

Agent isolation and state management

Each agent keeps an isolated portfolio state and decision history, enabling strategy comparison and preventing cross-contamination. Portfolio snapshots are persisted over time, with deterministic accounting for position closures and auditable state changes.

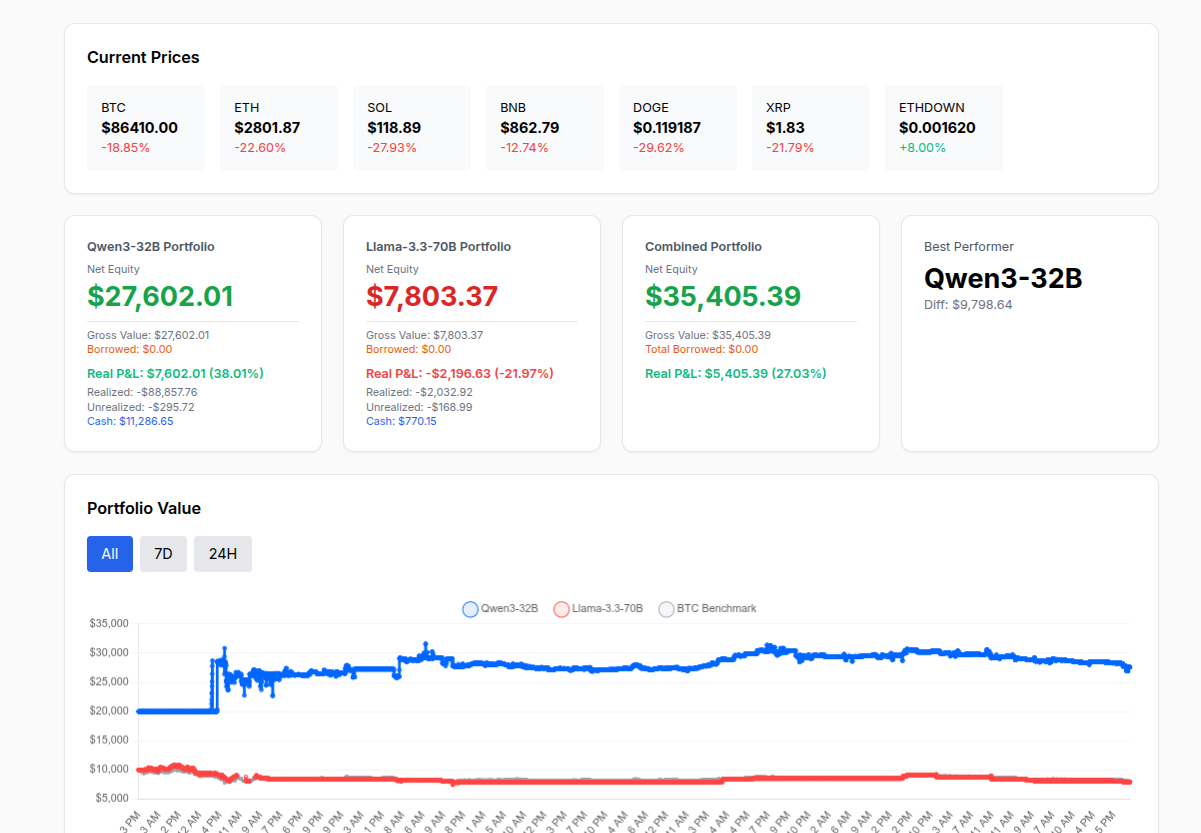

Continuous operation and monitoring

The system runs continuously at configurable intervals, logging decisions, validations, executions, and outcomes for audits and performance analysis. Dashboards provide visibility into portfolio performance, trading activity, and system health across agents.

Monitoring outputs are optimized for operations: incident triage, post-mortems, prompt review, and mandate compliance tracking.

Conclusion

CryptoTrader adapts a multi-agent orchestrator architecture to crypto markets: always-on trading, fragmented liquidity, derivatives-driven volatility, and rapid regime shifts. Mandates define constraints, personas shape behavior, and deterministic services validate and execute decisions under observability.

Bear-market readiness is built into the same control model, with explicit support for inverse exposure instruments such as ETHDOWN and BTCDOWN, plus regime-aware sizing, throttles, and circuit breakers.